The U.S. Cold Storage Market Size, Trends, Growth And Forecast For 2026-2034 - Miami Airport Warehouses

- Home

- Latest News

- The U.S. Cold Storage Market Size, Trends, Growth And Forecast For 2026-2034

The IMARC Group has released a comprehensive research report titled “US Cold Storage Market Size, Share, Trends and Forecast by Warehouse Type, Construction Type, Temperature Type, Application, and Region, 2026–2034.”

The IMARC Group has released a comprehensive research report titled “US Cold Storage Market Size, Share, Trends and Forecast by Warehouse Type, Construction Type, Temperature Type, Application, and Region, 2026–2034.”

The study provides in-depth insights into key market drivers, segmentation, emerging trends, growth opportunities, and the competitive landscape, offering a holistic view of current and future market dynamics.

Market Overview

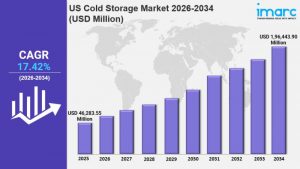

The US cold storage market was valued at USD 46,283.55 million in 2025 and is expected to reach USD 196,443.90 million by 2034, expanding at a CAGR of 17.42% during the forecast period (2026–2034). Market growth is primarily driven by the rapid rise in e-commerce grocery sales, increasing demand for pharmaceutical cold chain solutions—particularly for biologics and vaccines—and the growing adoption of automation technologies. In addition, stringent food safety regulations continue to support market expansion.

Study Timeline

- Base Year: 2025

- Historical Period: 2020–2025

- Forecast Period: 2026–2034

Key Market Highlights

- Market Size (2025): USD 46,283.55 million

- Projected CAGR: 17.42%

- Forecast Period: 2026–2034

- Growth is fueled by the surge in online grocery shopping and meal-kit delivery services, which are reshaping cold storage infrastructure.

- Rising pharmaceutical cold chain requirements for cell therapies and mRNA vaccines are increasing demand for ultra-cold storage solutions.

- Investments in automation and robotics are enhancing efficiency and addressing labor shortages.

- High construction, energy, and maintenance costs remain key challenges.

- Workforce shortages and aging infrastructure constrain capacity expansion and operational efficiency.

Market Growth Drivers

The rapid expansion of e-commerce grocery sales has significantly altered cold storage requirements across the US. According to Brick Meets Click and Mercatus, online grocery sales increased by more than USD 1 billion for the second consecutive month in September. This trend is driving retailers and third-party logistics providers to establish urban micro-fulfillment centers, reducing last-mile delivery times for perishable goods. These facilities rely on advanced automation, click-and-collect services, and integrated inventory management systems to enable real-time stock visibility and demand-based allocation. Growing consumer expectations for faster delivery of dairy products, frozen foods, and meal kits further accelerate market growth.

The pharmaceutical industry is also a major growth contributor, particularly with the rising adoption of cell therapies and mRNA-based vaccines. IMARC estimates the US cell therapy market reached USD 3.9 billion in 2024. Temperature-sensitive pharmaceuticals require storage conditions ranging from 2°C to 8°C for refrigerated products to –80°C to –60°C for ultra-low temperature vaccines. As a result, pharmaceutical companies increasingly outsource cold storage to specialized third-party providers equipped with validated monitoring systems, quality audits, and redundant cooling infrastructure to ensure product integrity.

Automation and robotics adoption continues to accelerate as operators deploy automated storage and retrieval systems (AS/RS), autonomous forklifts, robotic palletizers, and AI-driven inventory management platforms. These technologies help mitigate labor shortages, improve space utilization, and reduce energy consumption. For example, in October 2025, Tjoapack expanded its Clinton, New York facility with two new packaging lines, including a fully automated high-speed vial packaging line capable of processing up to 20 million units annually. Automation also minimizes human exposure to extreme temperatures while lowering long-term labor costs.

Market Segmentation

By Warehouse Type

- Private and Semi-private: Dedicated facilities serving specific clients or groups with controlled access and specialized storage.

- Public: Shared warehouses offering flexible, multi-client storage solutions.

By Construction Type

- Bulk Storage: Large-scale facilities designed for high-volume temperature-controlled storage.

- Production Stores: Cold storage units integrated with production or processing operations.

- Ports: Facilities located near ports to support import, export, and distribution activities.

By Temperature Type

- Chilled: Above-freezing storage for perishable goods.

- Frozen: Sub-zero storage for frozen foods and pharmaceuticals.

By Application

- Fruits and vegetables

- Dairy products

- Fish, meat, and seafood

- Processed foods

- Pharmaceuticals and biologics

By Region

- Northeast

- Midwest

- South

- West

Regional Insights

The US cold storage market is analyzed across the Northeast, Midwest, South, and West regions. While the report evaluates regional trends and market dynamics, it does not specify regional market shares, growth rates, or a dominant region. As such, comparative regional leadership insights are not detailed in the study. Click here to request a sample of the report.

Source: openPR